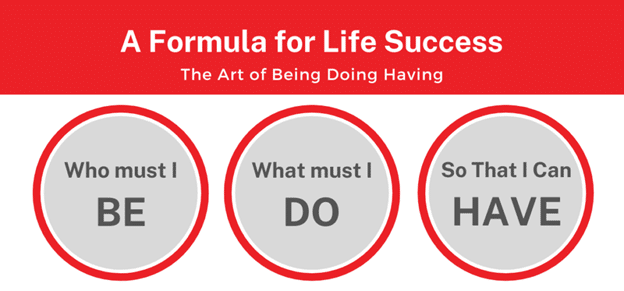

Every new year provides us with a chance to start fresh and get our finances in order. As we embark on 2024, it is essential to focus on achieving financial fitness by making goals. One of the crucial aspects of financial success is having a good plan. Your credit score plays a significant role in determining the opportunities available to you, such as access to cheaper credit, reward programs, and more. Wealth building also includes the practice of equity position, cash flow, savings, charitable contributions, tax advantages, and budgeting. Crush your goals this year by tailoring a plan that includes setting up your goals in a SMART format.

Get your free credit report and make sure it’s accurate: Start the year by checking your credit report at AnnualCreditReport.com. It is essential to ensure that all the information in your report is accurate. If you find any discrepancies, report them immediately. Consider closing retail accounts that you don’t use, but those open for longer periods does increase your score. Whenever possible, avoid “maxing out” your cards and try to use no more than 30% of your available credit line, also known as your credit utilization. Pay your bills on time. Your score builds over time and paying your bills on time keeps the score moving in the right direction. Don’t open too many new accounts. CreditKarma is also a great resource to help you build credit.

Create a budget that meets your goals: Budgeting is an essential tool for maintaining financial fitness. Use resources like NerdWallet’s budget worksheet to create a budget. Make sure to include your expenses, and factor in savings goals, such as an emergency fund, annual expenses, and retirement savings. You can also use a budgeting app that will allow you to control all your accounts in one place.

Refinance high-interest rate debt: High interest debt can take a toll on your finances, so consider refinancing to a lower rate. You can transfer balances to a credit card with lower interest or consolidate with a personal loan. There are many offers from which to choose, so be sure to research thoroughly.

Mortgage payments are one of the biggest expenses for most households, and it’s natural to want to pay off your loan as quickly and efficiently as possible. Luckily, there’s a way to do just that while also saving on interest and simplifying your budgeting process. Biweekly mortgage payments offer a convenient alternative to monthly payments and come with a host of benefits worth considering.

Create a savings plan: A sound savings plan is a vital part of achieving financial fitness. Dedicate 10% of your net pay to savings. Consider an online savings account with a higher interest rate, or a certificate of deposit, to maximize your savings power. CD accounts are a safe bet to build interest income at around 5%.

You may qualify for credit card with rewards, miles, cash, etc. As your credit improves so do the offers. Make your credit work for you and get the most for managing your money. Keep business expenses separate from personal with separate credit card and bank accounts. Put all expenses on the card and pay them off every month to max out your earning opportunities.

Find the best bank for your needs: Your bank plays an essential role in helping you achieve financial fitness. Do research, compare, and contrast the different banks and accounts that meet your needs. Look for accounts with no fees, low minimum deposits, and interest-bearing accounts. Do they offer the features you need for what you’re planning this year? Credit Unions tend to offer great rates on auto loans, larger banks offer more online features, do you need a bank with more locations and access or more long term goals such as starting or building a business? Having a relationship with a bank and holding accounts longer can work in your benefit.

Consider opening a Health Savings Account (HSA): An HSA is a tax-free way to save money for healthcare expenses. You can use it to pay for medical expenses, everyday items like ibuprofen, and even plastic surgery. The money you contribute is tax-deductible, and there is no penalty for unused funds. You can even use it after retirement to cover healthcare expenses.

Get a Good Tax person: A tax professional can help you ensure that you are taking advantage of tax credits, breaks and deductions available to you. They can help you understand how to maximize your tax refunds, and guide you on tax planning strategies for the year ahead. Contributions to retirement plans have annual limits, but offer tax deductions on federal income tax.

Achieving financial fitness is a journey, and it requires making deliberate choices about our finances. Your financial plan matters because it determines the opportunities available to you in achieving financial fitness. By following these tips, you can take control of your finances and work towards your goals. Now is the time to make positive changes, start today and begin the journey to financial freedom.